oregon tax payment deadline

2022 second quarter individual estimated tax payments. Personal Income Taxpayers September 15 2022.

Some Oregon Taxpayers Face Longer Waits For Refunds Kuow News And Information

September 15 2022 2022 third quarter individual estimated tax payments.

. Select a tax or fee type to view payment options. Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties. But by the 15th of this.

Oregon Department of Revenue PO Box 14725. Rule 1 If the federal tax due is less than 1000 at the end of. That will give them until Oct.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Property tax deferral. October 17 2022 2021 individual income tax.

The Department of Revenue is joining the IRS and automatically extending the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17. Oregon Deadline To File Pay Taxes Fast Approaching. Those who filed taxes by the Oct.

The due dates for estimated payments are. In most cases you must file and pay your taxes by July 15. To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use.

In addition to the payment options below we also accept payments in person at our office locations. Even though the income tax deadline is postponed until july there are thousands who still have to pay oregon taxes by april 15 and that has local accountants concerned. Choose to pay directly from your bank account or by credit card.

Mail a check or money order to. Quarter Period Covered Due Date 1st 1-1 to 3-31 April 20 2nd 4-1 to 6-30 July 20 3rd 7-1 to 9-30 October 20 4th 10-1 to 12-31 January 20 Annual Use Fuel User - Annual tax less than 10000. Electronic payment using Revenue Online.

The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19. Annual domestic employers payments are due on January 31st of each year. April 15 July 31 October 31 January 31 If you have any questions the tax office is open during regular business hours.

Oregon state university school calendar. Announced that the tax year 2020 federal income tax filing and payment due date for individuals would be automatically extended from April 15 2021 to May 17 2021. Eligible Virginians who filed their taxes by Nov.

On Wednesday March 25 Governor Kate Brown announced that tax. Taxpayers who need more time can request an extension on the IRS website. Estimated tax payments for tax year 2020 are not.

Form OR-40 OR-40-N and OR-40-P Oregon Personal. Generally these taxpayers must make quarterly tax payments if you expect your tax after withholding and credits including. Under the authority of ORS 305157 the director of the Department of Revenue has ordered an automatic extension of the Amusement Device Tax due date to April 14 2021.

The Oregon Department of Revenue reminds taxpayers and tax professionals about due dates for the next quarterly estimated tax payments. Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules. The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including.

The due date for applications for senior or disabled property tax deferral has been extended until June 15 2020. 17 extension deadline will receive their payments by Dec. By Donald Orr OPB July 15 2020 145 pm.

Six months after the original tax deadline in April. 1 will receive payments.

Oregon Non Profit Filing Requirements Or Annual Report Tax Exemption Renewal

Oregon Still Deciding Whether To Allow Coronavirus Grace Period For State Taxes Oregonlive Com

Oregon Kicker Rebate Of 1 4 Billion Tax Revenues Up 1 Billion In Stunning Forecast Oregonlive Com

Oregon Income Tax Calculator Smartasset

Oregon Tax Filing And Payment Deadlines Extended To July 15 Delap

Who Must Pay Oregon Income Tax

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Property Tax Payment Faqs Multnomah County

Coronavirus In Oregon State Delays Tax Filing Deadline Until July 15 Matching New Federal Deadline Oregonlive Com

Time Running Out For Oregon Families To Get Life Changing Monthly Payments Oregon Capital Chronicle

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Oregon Lawmakers Explore Wiping Out Stimulus Tax Penalty But Refunds Could Take Months Oregonlive Com

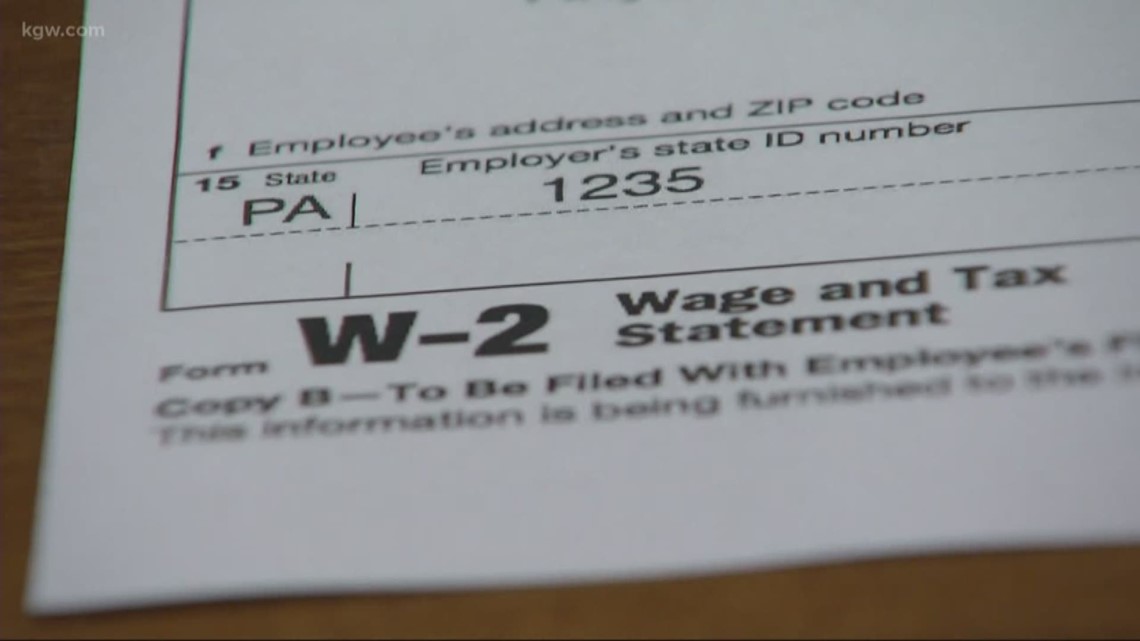

When Are Oregon Taxes Due In 2020 Kgw Com

Oregon S Tax Reconnect Adds To Life S Uncertainties Oregonlive Com

Even During Pandemic Oregon State Quarterly Taxes Still Due Kxl

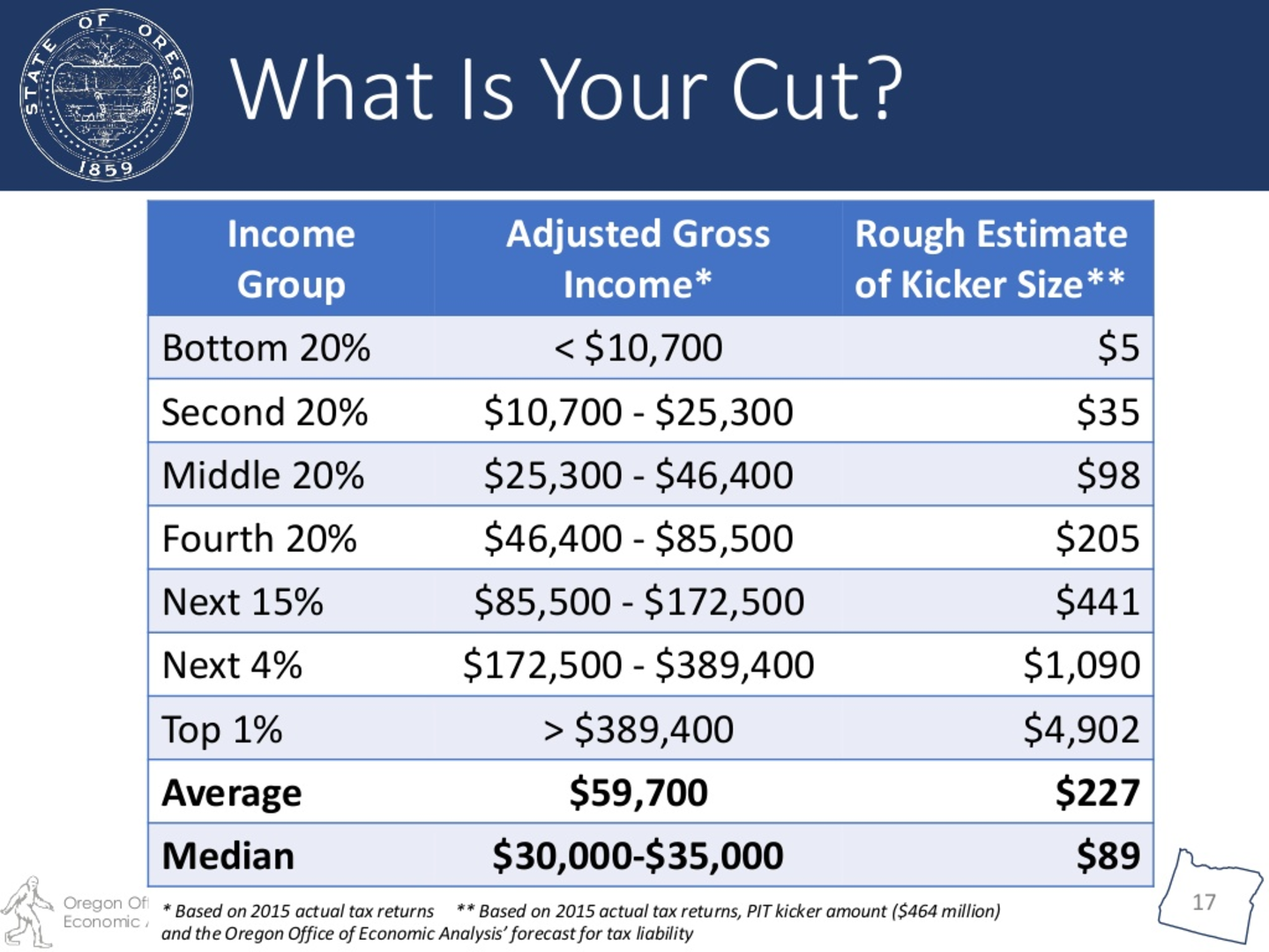

Here S The Kicker Oregonians To Receive A Tax Rebate In 2018 Opb

No More Delays What To Know About The July 15 Tax Deadline Koin Com